Welcome back guys! People need money for some reason Due to which people want to take loans to improve their financial condition. But it has become very difficult to take loan from banks, that’s why people apply for loan from online app because loan is available very quickly from online loan app without any heavy document process.

Many folks end up borrowing from fake loan apps, causing more financial trouble. So, let’s chat about key features of legit loan apps and dive into a review of Navi loan app. After this, you’ll feel more confident about borrowing from a trustworthy source.

What Is the Navi Loan App?

Navi loan app was launched in 2020 by sachin bansal who was the ex- CEO of Flipkart. Navi loan app provides digitally instant personal loan, home loans and health insurance to every class of people. Initially navi app used to provide only loan to the people but over time it is giving different types of financial products.

Navi Loan App Fake or Real – Complete Review

- Before knowing about navi loan app fake or real, let’s take a look at the history of navi loan app. sachin bansal, the ex-founder of india’s largest ecommerce company Flipkart, launched the navi loan app in 2020, which increases the trust on the navi loan app because the ex-founder of such a big company cannot launch the fake app.

- The office of navi loan app is present in hongasandra village hosur road, Bangalore and many employees work there. The company host a large workforce, continuously expanding by providing employment opportunities to numerous individuals. In contrast, the fake loan app lacks a physical office and fails to offer job prospects to anyone.

- Businessmen like sachin bansal buy equity (stake) of many companies. Together, their different types of business keep running, that is why such big businessmen do not cheat people by making fake apps. Because of doing fraud, he can also lose his stake in other companies.

- Navi loan app has been downloaded by more than 10 million people on play store, and it has got a good rating of 4.2 on play store. On the other hand, fake loan app does not get good reviews nor good ratings on play store.

- The fraudulent app has a pretty bad user interface with lots of issues, while the Navi loan app’s interface is top-notch and gets updated monthly.. Due to which, the bugs present in the app get fixed frequently.

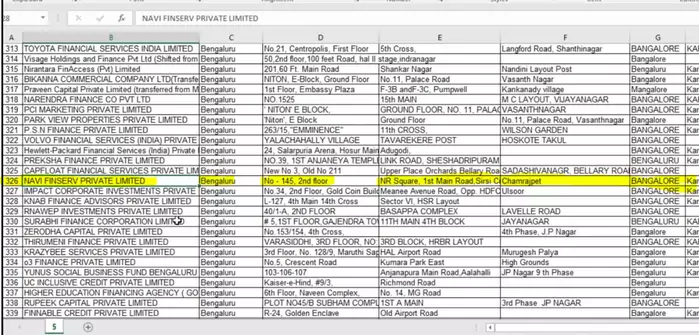

- The Navi loan app is an RBI-approved NBFC company, easily verifiable by visiting the official RBI website. In contrast, a fake loan app will never have RBI approval. You can spot Navi on the RBI’s website; we’ve even shared a screenshot as proof below.

- We had taken loan from navi app few months back. Then successfully we got the loan amount in the bank account after 2 days and the interest and installments mentioned by them are going on as mentioned while taking the loan.

- You will also get to see against review of navi loan app in many places, but those reviews are mostly of those people who are unable to repay the loan on time, or they do not know the term and condition of the loan. That is why we would advise that you read all the conditions carefully before taking a loan because the interest of an app like navi loan is higher than a normal personal loan and not paying the loan installment on time may cost you more penalty.

- For example, we have made a chart below in which the installation, interest and processing fees have been given for taking loan from navi app. That is why before taking a loan, definitely read their term and condition because digital app loan is a bit expensive compared to bank.

| Navi App Loan Amount | ₹50,000 |

| Navi App Loan Tenure | 12 months |

| Navi App Interest Rate on Loan | 22% ( Interest rate will be charged every month on the outstanding loan amount) |

| Loan EMI | ₹4,680 |

| Total Interest Payable on loan | ₹4,680 x 12 months =56,160 and interest amount is ₹6,160 |

| Processing Fees | ₹1,475 (While taking any kind of loan, additional fees are charged by the Navi company which are called processing fees) |

| Total Cost of the Loan taken from navi app | Processing Fees + Interest Amount = ₹6,160 + ₹1,475 = ₹7,635 |

Conclusion:

Friends, today we gave you complete information about Navi loan app fake or real, and finally we have come to the conclusion that navi loan app is real, and it is providing loan to people, that’s why you can use this app with certainty. Huh.

If a person asks for your personal information by becoming a representative of the navi app on the phone, then do not share any information with that person because the company never asks for personal information such as credit card, debit card number or OTP. If someone calls you and demands these things, then it can be a fake call. That is why never share your personal information with any company because nowadays, many fraud people are making fraud calls in the name of big companies.

FAQ:

How to Check Navi Loan Reviews?

Click on this link to check the review of navi loan app. After clicking, you can check the reviews of the navi loan app that present on the Play Store.

what is the Navi Loan customer Care number?

Navi Loan’s customer care number is currently closed, but you can contact them by emailing to help@navi.com.

Is Navi Loan App Rbi Approved?

Yeah, Navi Loan App is approved by the RBI. You can check out the list of RBI-approved loan apps on their official website.

Navi Loan App Fake or Real?

After doing complete investigation, we found that the navi app is genuine.

Good Job done. Keep it up;Specially in Insuarance section.